The Buzz on Pacific Prime

Insurance also assists cover prices associated with liability (legal obligation) for damage or injury caused to a third celebration. Insurance policy is an agreement (policy) in which an insurance firm compensates an additional versus losses from details backups or hazards.

Investopedia/ Daniel Fishel Lots of insurance plan types are readily available, and basically any type of individual or organization can discover an insurance coverage company eager to guarantee themfor a cost. A lot of people in the United States have at the very least one of these kinds of insurance policy, and car insurance is needed by state law.

Indicators on Pacific Prime You Need To Know

Locating the cost that is ideal for you calls for some research. Optimums may be set per duration (e.g., yearly or plan term), per loss or injury, or over the life of the plan, likewise known as the life time maximum.

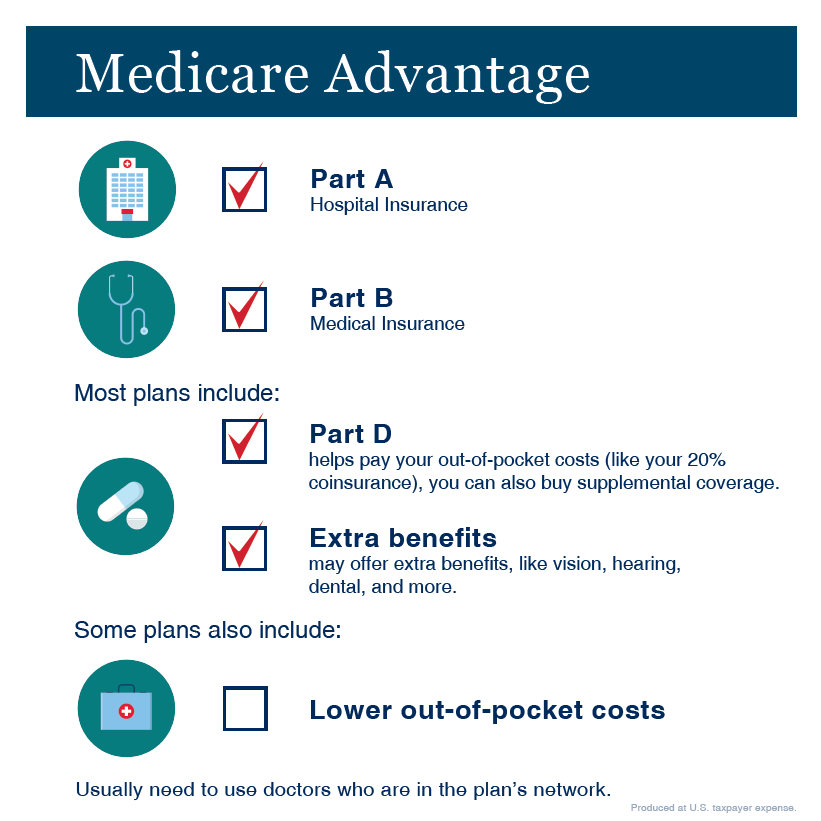

There are many various types of insurance coverage. Health insurance policy helps covers regular and emergency situation medical treatment costs, usually with the option to include vision and oral services individually.

Several preventative solutions may be covered for totally free prior to these are fulfilled. Wellness insurance might be bought from an insurance coverage company, an insurance representative, the government Wellness Insurance Industry, given by a company, or government Medicare and Medicaid insurance coverage.

The 15-Second Trick For Pacific Prime

Rather of paying out of pocket for car mishaps and damage, people pay annual costs to an auto insurer. The business after that pays all or many of the covered expenses related to an automobile accident or various other lorry damages. If you have actually a leased vehicle or obtained money to purchase a cars and truck, your loan provider or leasing car dealership will likely require you to lug vehicle insurance policy.

A life insurance coverage policy guarantees that the insurance company pays an amount of cash to your recipients (such as a partner or youngsters) if you pass away. There are 2 main types of life insurance coverage.

Irreversible life insurance covers your whole life as long as you proceed paying the premiums. Traveling insurance covers the expenses and losses related to taking a trip, consisting of journey terminations or delays, coverage for emergency situation health treatment, injuries and evacuations, damaged luggage, rental automobiles, and rental homes. Nevertheless, even a few of the finest travel insurance policy business - https://www.twitch.tv/pacificpr1me/about do not cover cancellations or hold-ups due to weather, terrorism, or a pandemic. Insurance policy is a way to manage your monetary risks. When you purchase insurance coverage, you acquire protection versus unanticipated economic losses.

Things about Pacific Prime

Although there are several insurance plan types, some of one of the most typical are life, health and wellness, property owners, and auto. The ideal sort of insurance coverage for you will rely on your objectives and financial scenario.

Have you ever had a minute while looking at your insurance coverage policy or purchasing for insurance coverage when you've assumed, "What is insurance? Insurance coverage can be a mystical and perplexing thing. How does insurance policy job?

Experiencing a loss without insurance coverage can put you in a tough economic situation. Insurance is a vital monetary tool.

What Does Pacific Prime Mean?

And in many cases, like automobile insurance and employees' payment, you may be called for by legislation to have insurance policy in order to shield others - global health insurance. Find out about ourInsurance options Insurance coverage is basically an enormous nest egg shared by lots of people (called policyholders) and managed by an insurance coverage service provider. The insurer makes use of money accumulated (called premium) from special info its insurance holders and other financial investments to pay for its operations and to accomplish its pledge to policyholders when they submit a claim